Senate Seeks Explanation From CBN Over Alleged Non-remittance Of N1.44tr Surplus

The Senate has asked the Central Bank of Nigeria, CBN, to provide a comprehensive explanation for the alleged non-remittance of N1.44 trillion in operating surplus.

This is as the CBN has rolled out positive outlook of Nigeria economy in the second half of 2025 to Nigerians through statutory, declaring that Nigeria’s economic recovery had entered its most stable and promising phase in more than a decade.

The Senator Adetokunbo Abiru (APC, Lagos East) led Senate Committee on Banking, Insurance and Other Financial Institutions made the call for transparency, insisting that public trust in monetary governance hinged on a clear and unambiguous response to the Auditor-General’s query on the controversial surplus funds.

Abiru commended the apex bank for the positive trajectory the Nation’s economy assumed from the beginning of the year but tasked it to increase the tempo for more stabilised economy in 2026, just as he acknowledged the CBN’s achievements in stabilising the foreign-exchange market and driving down inflation.

The Chairman said, “These positive indicators have not gone unnoticed globally. I commend the Bank and its leadership for the role played in earning the country favourable ratings from Fitch and S&P Global Ratings, reflecting improved investor sentiment, policy credibility, and macroeconomic stability.”

As bank rolls out positive outlook of Nigeria economy

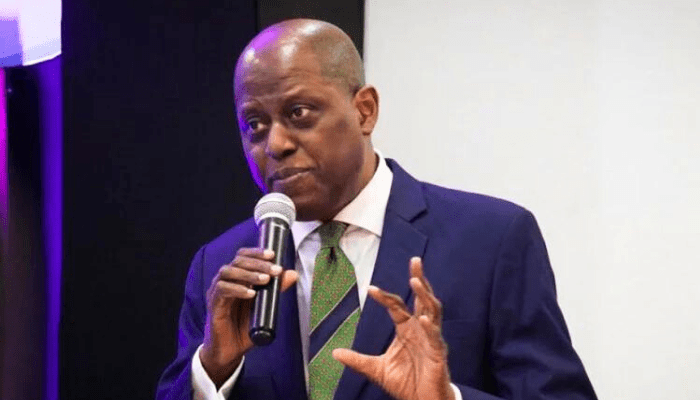

In his submission, CBN Governor Olayemi Cardoso who presented a detailed review of the economy, asserting that Nigeria was witnessing renewed macroeconomic stability across all major indicators, adding that the combination of bold monetary reforms, foreign-exchange market liberalisation and disciplined liquidity management since mid-2025 had produced outcomes that were attracting international recognition.

The CBN governor who noted that at the domestic front, real GDP growth sustained its positive trajectory with the economy expanding by 3.98 per cent in the third quarter of 2025.

This according to him, was higher than the 3.86 per cent recorded in the corresponding quarter of 2024 but 0.25 percentage point lower than the preceding quarter

“The key contributors to the broad-based growth include crop production, ICT, real estate, and financial and insurance,” he said .

He added that inflation fell for seven consecutive months to 16.05 per cent as of October 2025, from a peak of 34.6 per cent in November 2024, the lowest in three years.

Food inflation, which according to him, is the largest single component of the basket, also fell to 13.12 per cent in October, down from 21.87 per cent in August.

“This steady disinflation is restoring real purchasing power for households and businesses, and we remain fully committed to pushing inflation down to single-digit levels over the medium term,” he said.

He told the committee that the most visible sign of renewed confidence in our economy is the transformation of the foreign exchange market, saying “ the once-substantial gap between official and parallel market rates has shrunk to under 2 per cent, down from over 60 per cent a year ago.”